http://finance.yahoo.com/news/FDIC-could-seek-bailout-from-apf-3266069115.html?x=0&.v=9

"Congress in May more than tripled the amount the FDIC could borrow from the Treasury if needed to restore the insurance fund, to $100 billion from $30 billion."

"The FDIC estimates bank failures will cost the fund around $70 billion through 2013. Ninety-four banks have failed so far this year. Hundreds more are expected to fall in coming years largely because of souring loans for commercial real estate"

"Regulators have approached big banks about borrowing billions to shore up the dwindling fund that insures regular deposit accounts. "

"The loans would go to the fund maintained by the Federal Deposit Insurance Corp. that insure depositors when banks fail, said two industry officials familiar with the conversations, who requested anonymity because the plans are still evolving."

Problem: the Federal Reserve

Solution: Bring down the Federal Reserve (End Central Banking, end fiat money, end fractional reserve banking, stop monetizing debt, etc...)

Scenario:

Joe American has $10,000 dollars. Joe deposits it into the local bank into a savings account with .10 interest rate. Joe thinks his money is safely nestled in a large fireproof/bombproof state of the art vault. When in reality, he is taking a HUGE RISK for a little profit. Most people don't realize that banks take your money and invest it in risky monetary ventures in hopes of making more capital...Your money does not sit idly.

DO THE MATH:

Savings Account Balance: $10,000

Interest Rate on this Account: .10% (current rate for Bank of America Savings Acct)

Amount of Money you are earning: $10 A MONTH!

Another Math Problem:

Savings Account Balance: $10,000

Interest Rate: 6%

Amount of Money you earn: $600 a month!

Hyperinflation or stagflation is inevitable. By using simple logic, anyone can come to the conclusion that you cannot keep printing paper money which is not backed by anything of intrinsic value (gold or silver) and expect to have economic growth and job creation. You cannot use a credit card to pay off your other credit card debt. It is a dangerous, endless cycle where the borrower is literally slave to the lender.

Temporary Solution:

Sounds crazy! But you need to PULL your money from your savings account. Invest some in gold and silver coins, basic food/water/and medical supplies, purchase some guns/ammo for self defense/home protection, and keep some paper cash on hand at home.

Your homework:

American Hyperinflation 1 of 4-

Moneymasters-

http://video.google.com/videoplay?docid=-515319560256183936

End the Fed by Ron Paul

http://www.amazon.com/End-Fed-Ron-Paul/dp/0446549193

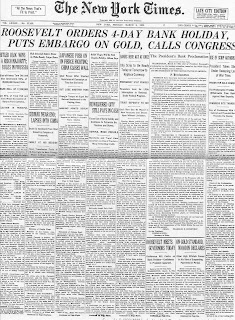

Banking Holiday (banks lock their doors and you cannot withdraw your money)-

http://en.wikipedia.org/wiki/Emergency_Banking_Act

Link to Bank of America current interest rate in Savings Acct.-

Look for the sequel to this article in a couple of days...It will cover how the Financial Crisis of 1933 made John Dillinger a folk hero, German hyperinflation, and how history exists in cycles (you can predict trends/forecasts)

No comments:

Post a Comment